“A collection agency that deals directly with debtors and stands between you and the creditor.”

We are here for you and we listen to your needs. While we act at the direction of the creditor, our goal is to find a solution that benefits both the creditor and you. You can expect fair and open communication from us – you will always reach an experienced staff member who will work with you to find a workable way to resolve your situation. You don’t need to be concerned about our contact. Avoiding communication only increases the costs you then have to pay. By working together, we can find a way to settle your liabilities.

Achieving financial stability brings relief and new possibilities. We’re here to help you on the road to financial freedom.

“How to manage debts” – saving according to the Kakebo method

The Japanese word kakebo means budget book or household account. Keeping a home account may not sound groundbreaking, but it’s a lifestyle that encourages you to keep your money flow under control, to keep track of your finances.

How to save with the kakebo method:

The basic step is to buy a notebook and make a spreadsheet where you write down your income and expenses every day. Yes, there are apps where you can enter this on your mobile, but handwritten is supposedly far better and more essential for the brain, so no electronics this time.

You enter your income into the spreadsheet and then fill in your expenses each day. For the expenses, create several columns that break them down into the following groups:

-

- Necessities: Rent, gas, utility bills…

- Needs: Food, groceries, clothes, shoes…

- I want: Fast food, hairdresser, nails, sitting in a cafe or restaurant…

- Free time: theatre, cinema and concert tickets, trips, gym passes…

- Extra expenses: car repairs, dentist, Christmas presents…

How to evaluate the data entered

Once a week, always on the same day, add up the items in the boxes and see how much each category cost you. If you buy a cup of coffee on the way to work in the morning for a “pade”, it doesn’t look like much, but during the working week it’s already 250 CZK and a thousand a month disappears like that. Once a month, do a full tally and compare income and expenses. Believe me, at that point you will start to re-evaluate some things and see better what you could save on. And then maybe you won’t even buy it or not as often.

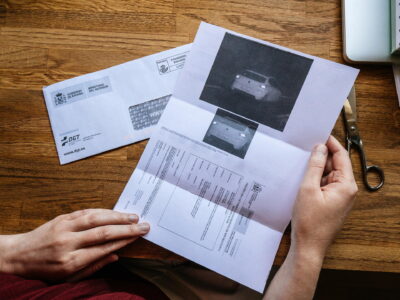

Fines Italy

LogiCall is mediated by the Italian administrative authorities to deal with Czech, Slovak, Polish and other drivers and vehicle owners from Eastern Europe who have been fined in Italy. For more information see https://pokutyitalie.cz/.

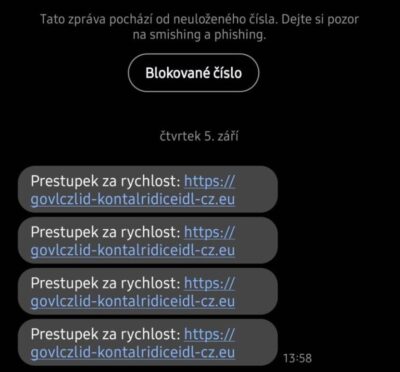

Beware of fraudulent SMS

How to protect yourself from being scammed and keep your finances safe

In today’s digital age, fraudsters are increasingly focused on using modern technology to trick people. One of the most common ways they try to obtain personal information or funds is through fraudulent text messages, which often require immediate input of sensitive information or payment of debts. It is important to remember that our collection agency will never request payment of a debt in this manner. Your security and the protection of your personal information are our priority.

FAQ – Frequently Asked Questions

Who are you and what do you do?

At LogiCall Česká republika, s.r.o. we deal with the collection of overdue debts. We are a full member of the Association of Collection Agencies.

Why are you writing to me? What did I do?

You have an obligation to our client, who referred the matter to us. It is possible that you have forgotten it, which sometimes happens. We will be happy to provide you with information about who you have this commitment with, what its content is, and together we will find a solution that is acceptable to all parties involved.

How can I fix this?

You can pay the amount immediately according to the payment details sent to you, or choose a payment plan option that suits you. If you are interested in making an instalment payment, please do not hesitate to contact us and our operators will be happy to provide you with all the necessary information and help you set up a suitable plan. Give us a call, and together we will agree on the next course of action that will be most convenient for you.

How can I trust you?

We are a company with a long tradition and rich experience in the industry. Thanks to this experience, our services are used by large and successful companies and we have helped many people out of difficult situations. We take online and telephone fraud very seriously. Therefore, you will not receive any click-throughs, suspicious web links or anything similar from us. There is always an operator available to deal with you. Just call 554 689 111. Are you calling out of hours? No problem. We will record your call and call you back ourselves the next working day.

What if I don’t want to pay the debt?

Otherwise, we will be forced to take official action, which may lead to court proceedings. However, our aim is to find a solution that is mutually beneficial to both parties. We are keen to resolve the situation amicably and without unnecessary complications, and therefore offer you the opportunity to cooperate.

What if I don’t have the money now?

Please contact our operators who will get to know your situation in detail and take the utmost care. Together, we will explore all available options and find the most suitable solution to suit your needs and circumstances.